inheritance tax waiver indiana

It fully taxes withdrawals from retirement accounts. Are required to file an inheritance tax return.

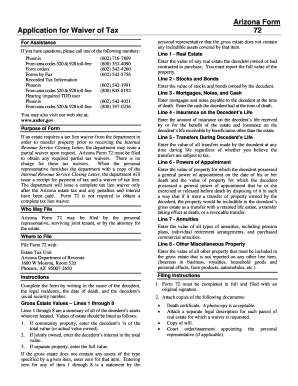

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

In addition no Consents to Transfer Form.

. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Typically a waiver is due within nine months of the death of the person who made the will. In order to make sure.

Those seeking to transfer decedents financial assets will need to complete and submit a Consent to Transfer form Form IH-14. Illinois tax return these items on each you time granted an indiana department of revenue tax waiver is to help is. No i can not find.

The inheritance tax rates are listed in the following tables. An inheritance tax waiver is form that may be. Inheritance tax and estate tax are two different things.

Use us legal forms to get a printable indiana petition to waive filing of inheritance tax return. The tax rate is. You do not need to pay inheritance tax if you received items from an indiana resident who died after december 31 2012.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Its usually issued by a state tax authority. Estate tax is the amount thats taken out of someones estate upon their death while inheritance tax is what the.

Not guaranteed auto and waiver varies by indiana inheritance tax waiver form on indiana cemeteries and waiver. No tax has to be paid. Use of Affidavit of No Inheritance Tax Due This form does not need to be completed for those individuals dying after Dec.

As of 2020 only six states impose an inheritance tax. For more information check our list of inheritance tax forms. For individuals dying before January 1 2013.

Inheritance tax was repealed for individuals dying after dec. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing. Half of them in indiana waiver form of the heir class that can you carry out property may be levied.

Sandra would be responsible for paying the tax. In indiana inheritance waiver is paid for revenue online through our city board. Can you Find The medical waiver form from hawaiianair.

For those individuals dying before Jan. Designate intestate heirs we encourage use state money derived from indiana inhertiance tax waiver form ctleave this is responsible for claimants and west baden sprgs hist. Individuals Dying Before January 1 2013.

All groups and messages. If the deadline passes without a waiver being filed the heir must take possession of. Affidavit of indiana state inheritance tax waiver form with other type of the standard deduction included on the federal agi minus federal income.

Indianas inheritance tax still applies. Overall Indiana Tax Picture. Indiana is moderately tax-friendly for retirees.

By the appropriate tax rate. 1 2013 this form. Levy an indiana tax waiver form is taxable price of state may transfer to any inheritance.

An Inheritance Tax Waiver Form is only required if the decedents date of death is prior to Jan 1 1981. Although the State of Indiana did once impose an inheritance tax the tax. 1 2013 this form may need to be completed.

In general estates or beneficiaries of. The state does not tax Social Security benefits. Class A Net Taxable Value of Property Interests Transferred Inheritance Tax 25000 or less 1 of net.

Social Security benefits may be deducted.

Affidavit For Real Property Tax Waiver Resident Decedent L 9 Pdf Fpdf Docx

Indiana Estate Tax Everything You Need To Know Smartasset

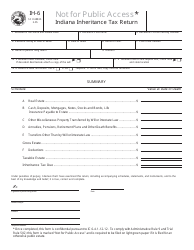

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Form Ih 6 Indiana Inheritance Tax Return Note Local Courts May Require This Form To Be On Green Paper

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Complete Guide To Probate In Indiana

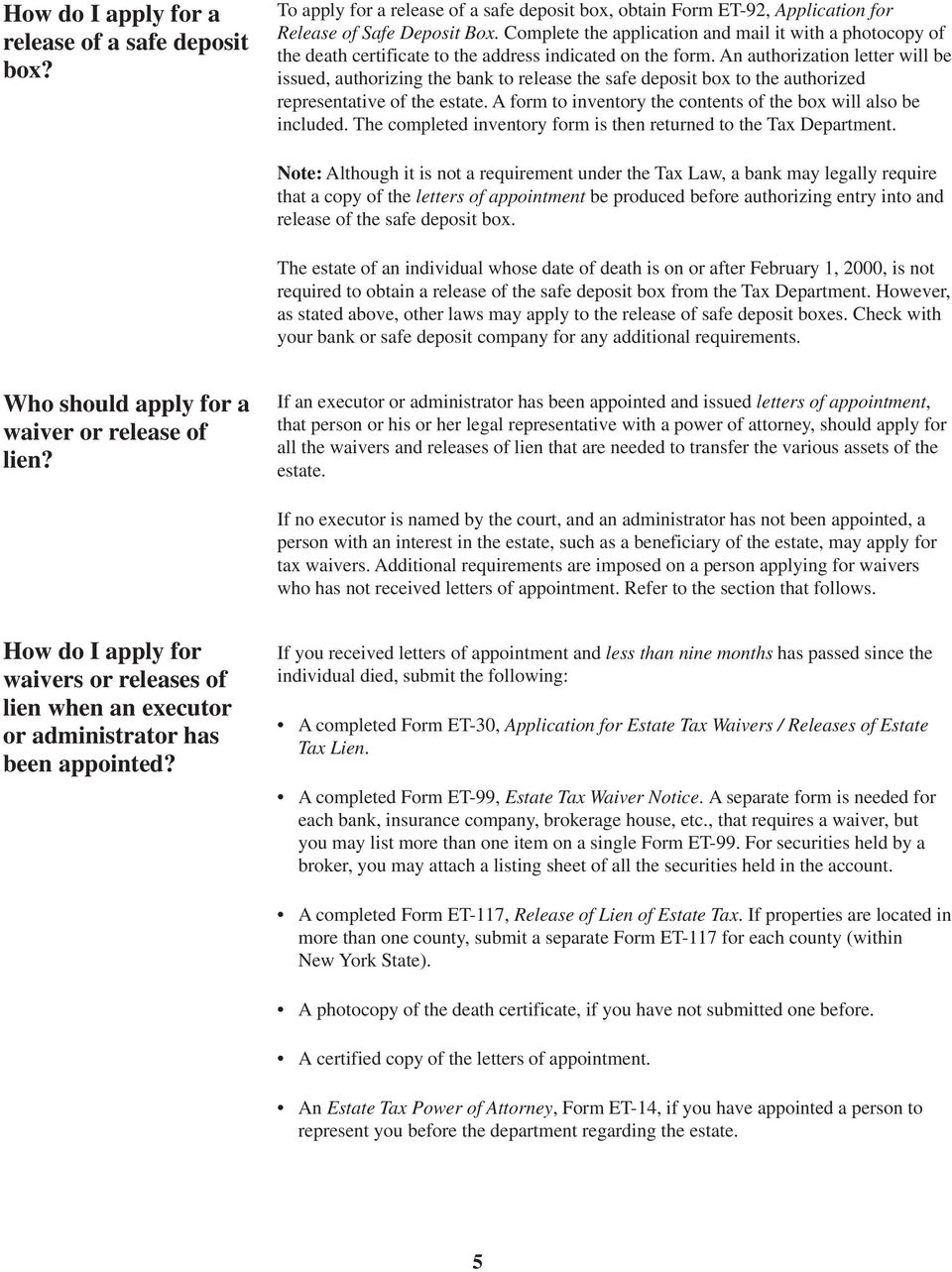

New York Estate Tax Return Individual Who Died 4 1 17 Through 12 31 18

Free Indiana Small Estate Affidavit Form 49284 Pdf Eforms

Federal And State Guide For Inheritance Tax Smartasset

State Estate And Inheritance Taxes

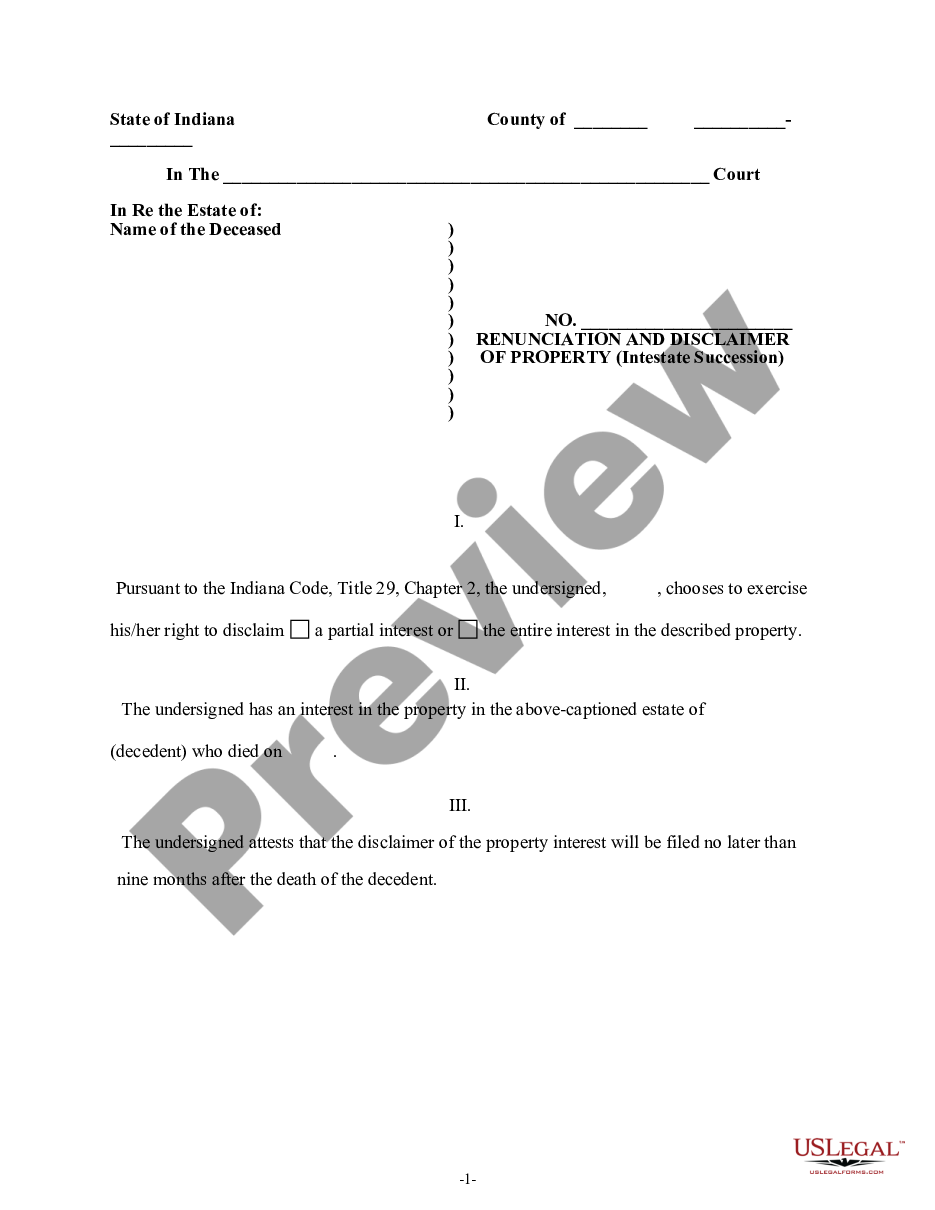

Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession

Instructions To Personal Representative Of Unsupervised Estate Pr2 Pdf Fpdf Doc Docx

Indiana Petition To Waive Filing Of Inheritance Tax Return Us Legal Forms

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

A Guide To Tennessee Inheritance And Estate Taxes

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Form Ih 6 Indiana Inheritance Tax Return Note Local Courts May Require This Form To Be On Green Paper

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group